I like the Inland Revenue. They have just accepted my argument put to them, about not paying tax revenue, to a government that terrorises other nations by bombing them.

I don’t normally earn enough to pay tax, however last year I was late in making out my tax form, and thereby accrued a fine of thirteen hundred pounds. To a demand for payment, I replied:

N.Kollerstrom PhD

60, Barrett Road,

E17 9ET

to: HM Revenue and Customs,

Pay as your earn and self-Assessment,

BX9-1AS

5 March 2015

Dear Sir,

I have all my life made my tax returns regularly and on time, except for a couple of years ago when I was delayed by some months. For this you have now imposed a fine upon me of thirteen hundred pounds; even though my tax returns (for some years, since I have retired) do not involve me in paying any tax. I would like if I may to give you the reason for my delay in the 2012-13 tax form.

I as a peace-loving citizen, am not in favour of acts of mass murder and the bombing of other countries’ capital cities. This had taken place just before that period, with Libya, and I was still in a deeply shell-shocked condition. Libya was the most prosperous and optimistic of African cities and is now a total ruin thanks to the British bombing. I well remember William Hague smiling as he told how he was ordering fifty RAF airstrikes a day upon Libya. No-one was very clear what Libya was supposed to have done wrong. Their President Ghadafy had even succeeded in turning the desert green with his grand irrigation system around the North Sahara, what a glorious achievement, and that was blown to bits by British bombs. The citizens are back to the old grinding poverty of their ancestors.

Sir, please allow me to draw to your attention to the Terrorism Act of 2000. Concerning fundraising, it stipulates in Section 15:

1.A person commits an offence if he invites another to provide money or other property, and intends that it should be used, or had reasonable cause to suspect that it may be used, for the purpose of terrorism. [Demanding Tax]

2. A person commits an offence if he receives money or other property, and intends that it should be used, or has reasonable cause to suspect that it may be used, for the purpose of terrorism. [Collecting Tax]

This must include, I hope we can agree, funding collected eg by yourself, for a process of terrorizing the people of Libya and destroying their homes, livelihood, electricity, water etc.

Or alternatively, you may wish to claim that any state-sanctioned acts of terror are ipso facto excluded from this 2000 Terrorism Act. You have probably been told this.

First of all, let us note that the Magna Carta the basis of British justice makes clear that the law must apply to all persons, that there can be no such exemptions from its reach. Secondly, allow me to point out, that a certain judgement reached in October 2013 by the Supreme Court (R v Gul UKSC 64), emphasised that “the definition of terrorism in section 1 in the 2000 Act is, at least if read in its natural sense, very far reaching indeed,” and helpfully explained:

28: As a matter of ordinary language, the definition [of terrorism] would seem to cover any violence or damage to property if it is carried out with a view to influencing a government or IGO in order to advance a very wide range of causes. Thus, it would appear to extend to military or quasi-military activity aimed at bringing down a foreign government, even where that activity is approved (officially or unofficially) by the UK government.

That 2013 Supreme Court judgement is binding upon UK citizens. It prevents me from paying money that could in any way support a terrorist cause or agenda.

You, good sir or madam, may wish to examine your conscience and consult a lawyer as to whether your position as collecting tax revenue for the purpose of terrorizing another nation that cannot defend itself may not have become, in consequence of this judgement, rather problematic. (Somewhere around one billion pounds of UK taxpayer revenue went into that assault)

There is only this once I have done this and it won’t be repeated.

Yours in peace,

PS, if you should perchance wish to take me to court over this issue I would be most grateful if you could also send me an email ( … ) to advise me of the letter.

Copy to Dryden Fairfax Solrs, Bradford.

Tax Ref. No: …

( See here, scroll halfway down to get to Article 28)

…*…*…*…

This was followed by a second letter:

A. Thanda,

H.M. Revenue and Customs

Pay as you Earn, BX9 1AS

2 May 2015

your ref: 6437061789

Dear Ms Thanda,

Thank you for your letter of 19 March explaining that my appeal against the fine of £1300 sterling for late completion of my Self-employed Tax form (which had accrued no tax), was too late, so you could not consider it. The next day you commissioned the Equita debt-recovery company: they have told me that I have failed to pay a liability order which was issued through the Magistrates Court; and I am therefore copying this missive to Equita as well.

I was not informed of this Magistrates Court hearing. Is it possible, Ms Thanda, that we could take this through proper lawful procedure rather than descending to threats of violence? I have sent you a letter (March 5), explaining to you that which legally impedes me from paying the sum you believe is properly due.

The threat of violence and theft of my property which I have now received from Equita (20 March, their ref. 15658293) is entitled ‘Notice of intention – Unpaid council Tax’ – however there is no unpaid council tax. You might wish to correct them here.

Surely the proper procedure now is to allow me a court hearing, if you believe I am in breach of the law?

Yours, etc.

…*…*…*…

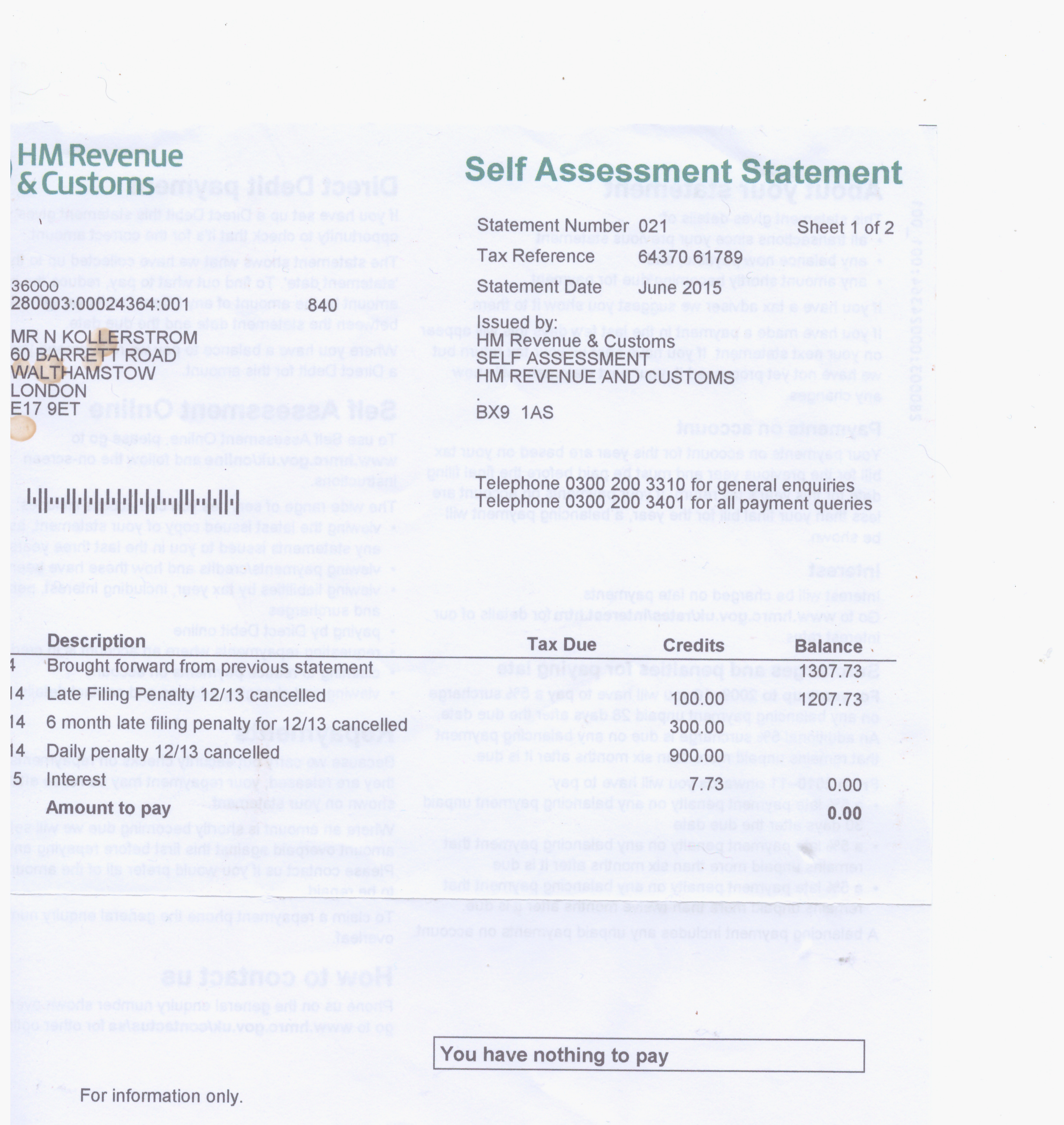

Following this exchange of letters, I received a notification of cancellation of the debt:

Thanks to Chris Coverdale of Make Wars History for the legal argument.